In this section

In this sectionBlended finance may be part of the solution to bridging the funding gap and driving self-sustaining solutions in displacement settings - delivering the energy needs of the displaced and supporting the required institutional energy transition that traditional grant-based funding has proven unable to.

What is blended finance?

Blended finance is defined as an approach for increasing the amount of project funding by combining different types of financing from different sources and/or for different purposes, which contribute to development, social, environmental or humanitarian goals and generate financial returns. In essence, blended finance is a mechanism that allows organisations with different objectives to ‘invest’ alongside each other while achieving their own objectives.

There are three key characteristics associated with blended finance:

- Leverage: Use of humanitarian and/or development finance and philanthropic funds to attract commercial finance into projects.

- Impact: Investments that drive development, social, environmental and/or humanitarian progress.

- Returns: Financial returns for private investors in line with market expectations, based on real and perceived risks.

What does blended finance look like?

As outlined by the Organisation for Economic Co-operation and Development (OECD) and the World Economic Forum (WEF), blended finance can include one or more of the following financial support mechanisms: 1. Direct funding for the removal of commercial barriers; 2. Technical assistance; 3. Risk transfer mechanisms; and/or 4. Market incentives.

What role can it play in bridging the clean energy funding gap in displacement settings?

The role of blended finance is to increase returns and/or lower risks for a commercial entity, which in turn allows it to mobilise private capital to develop markets it would not normally enter. In providing an improved risk-return proposition for the private sector, blended finance can help bridge funding gaps as the private sector invests its own money into the solution.

Humanitarian actors are interested in blended finance due to its ability to mobilise private sector investment in delivering long-term, sustainable solutions in what are perceived to be high-risk settings while addressing their own funding gap. Blended finance is seen as a mechanism to mobilise private sector investment to support the delivery of the SDGs.

With respect to energy programming in displacement situations, blended finance is a mechanism that can leverage the mobilisation of private capital through grant funding, which, when combined, can deliver sustainable energy solutions in emerging or frontier markets that exist in and around many displacement settings.

Current activities around blended finance in displacement settings

Driven by NORCAP’s interest in blended finance solutions in displacement settings, the GPA Coordination Unit has composed an initial overview of Blended Finance Solutions for Clean Energy in Humanitarian and Displacement Settings. This report, along with its associated Blended Finance Toolkit for Clean Energy Solutions in Humanitarian and Displacement Settings provide an overview of blended finance mechanisms and their role in delivering sustainable energy solutions as part of humanitarian response. The report highlights key lessons learned from the use of different blended finance mechanisms in displacement settings and makes recommendations for their continued development.

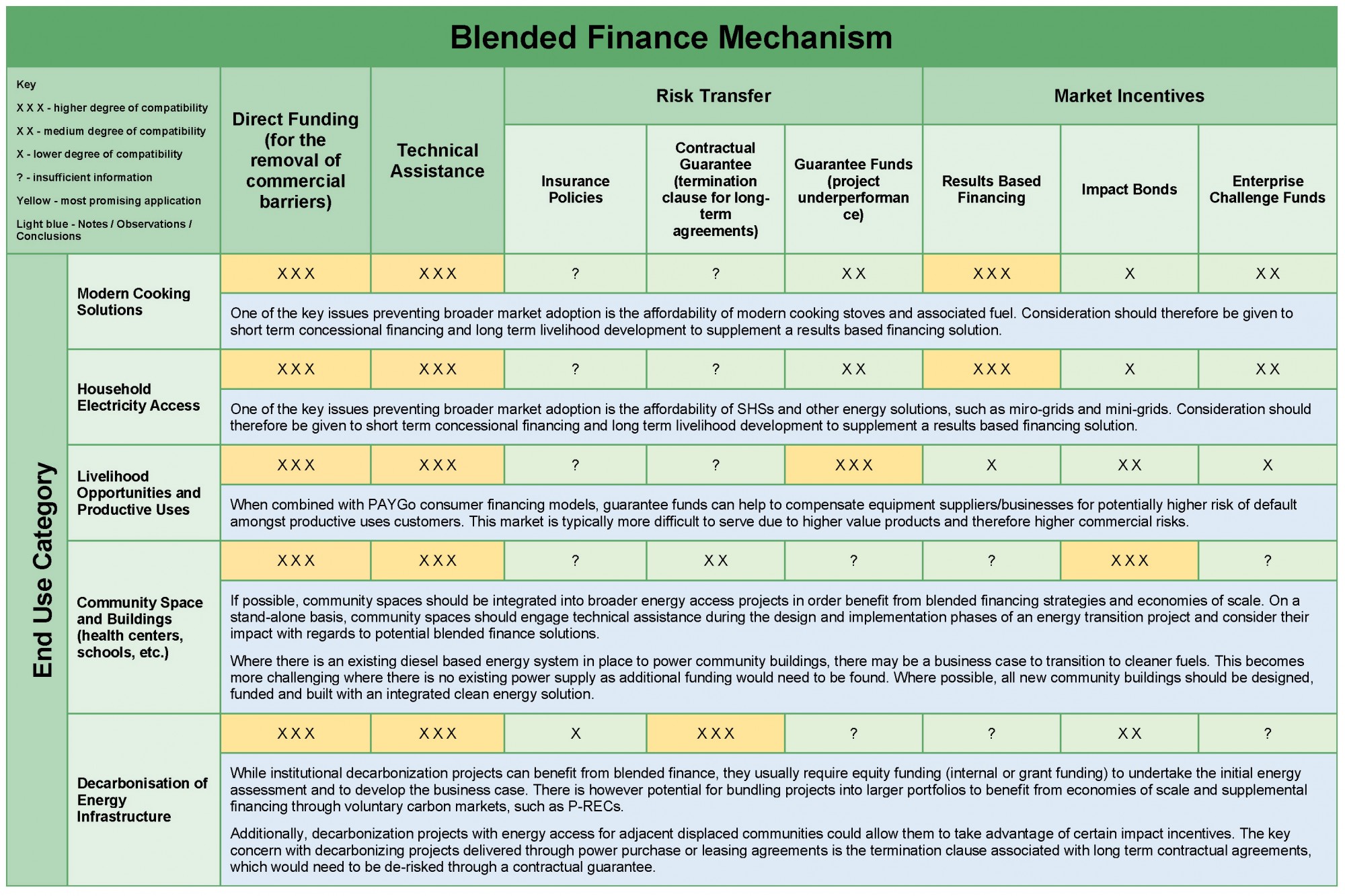

The report’s associated Toolkit includes a high-level summary of developing blended finance solutions in humanitarian and displacement settings, and identifies relevant stakeholders and their input to developing such solutions. It contains a summary Blended Finance Compatibility Matrix (see below) that identifies the most favourable blended finance mechanisms for a particular clean energy project and an overview of the three most promising financial mechanisms, as evaluated by the NORCAP Blended Finance Working Group. The toolkit is aimed at supporting energy specialists to develop market-based clean energy solutions in contexts that require blended finance solutions to support commercially sustainable interventions.

Blended Finance Compatibility Matrix (as can be found in the Blended Finance Toolkit for Clean Energy Solutions in Humanitarian and Displacement Settings)

Blended Finance Compatibility Matrix (as can be found in the Blended Finance Toolkit for Clean Energy Solutions in Humanitarian and Displacement Settings)

Recommendations and Next Steps

In order to assess whether blended finance is needed and how it can be effectively structured, it is essential to understand the relevant restrictions and market failures, and the sectoral, country and humanitarian context.

Not every mechanism is, however, suitable for financing each type of project. The goal of the Blended Finance Compatibility Matrix, the core of the Blended Finance Toolkit, is to depict the level of compatibility of each blended finance mechanism towards various end uses.

Although examples of blended finance mechanisms in displacement settings that can provide crucial insights are emerging, there is limited experience in using blended finance mechanisms to deliver SDG7 in displacement settings. More data and objective evaluation is needed if the risks and returns are to be appraised fully and future mechanisms structured appropriately.

The GPA Coordination Unit will continue to evaluate financial instruments and, where practical to do so, continue coordinating the NORCAP Blended Finance Task Force, comprising of key actors, to co-design, forge project partnerships, seek funding for, implement, verify and share the results of pathfinder blended finance projects.

This blog was written by Arielle Ben-Hur of the GPA Coordination Unit at UNITAR.

Last updated: 13/01/2022